That Was The Week That Was - 17th May 2025

Strategic Briefing: 10th–16th May 2025

1. Introduction

It’s been the kind of week where the headlines read like history in motion—until you examine the small print. Presidents toured palaces, missiles were intercepted at supersonic speed, and trade wars seemingly thawed overnight. But as ever in geopolitics, what’s signed with a flourish often hides the footnotes of fragility.

From the Gulf’s golden promises to Romania’s political pivot and China’s carefully choreographed détente, this week was less about what happened and more about how it was presented. And for those watching closely, the devil—as usual—is in the data.

2. Top Geopolitical & Defence Events of the Week

Trump’s Middle East Tour: Optics, Economics, and Overtures

President Donald Trump concluded a whirlwind four-day tour of Saudi Arabia, Qatar, and the UAE—a regional charm offensive heavy on handshake diplomacy and headline investment figures.

- Saudi Arabia reportedly pledged $600 billion in sectoral investments, including defence and energy.

- Qatar announced a $96 billion Boeing deal, framed as the largest in the airline’s history.

- The UAE made headlines with a $1.4 trillion investment commitment over ten years into AI and technology sectors.

Caution Required: Many of these numbers are amalgamations of previously agreed frameworks, extended timelines, and non-binding MOUs. The White House’s own fact sheets indicate that much of the UAE figure was committed in earlier phases, with this week’s announcements accelerating—but not originating—the spend. Similarly, the Qatari aircraft order, while real, is backloaded over multiple years and still subject to regulatory review.

The strategic subtext? Trump bypassed Israel entirely, met directly with Syria’s president, and suggested that sanctions relief on Damascus could be “on the table”—a subtle but unmistakable shift away from old orthodoxies. The transactional tone and focus on industrial returns mark a recalibrated U.S. posture in the Middle East.

U.S.–China Tariff Truce: A 90-Day Pause, Not a Peace Deal

On 12 May, Washington and Beijing agreed to temporarily slash tariffs in a 90-day pause on their long-running trade conflict:

- U.S. tariffs on Chinese goods reduced from 145% to 30%

- China reciprocated, cutting duties from 125% to 10%

Markets surged. Diplomats praised “constructive tone.” But under the surface, the core tensions—tech access, IP rights, strategic dependencies—remain unresolved. The agreement is better viewed as a tactical de-escalation, buying time for both economies, rather than a strategic realignment.

Romania’s Runoff: A Fork in the Road

On 11 May, Romanians returned to the polls for a presidential runoff, choosing between:

- George Simion, a nationalist firebrand with anti-Brussels leanings, and

- Nicușor Dan, a centrist technocrat favouring EU integration.

The election, re-run after last year’s vote was annulled over alleged Russian interference, is being watched across NATO. A Simion victory could weaken cohesion on the alliance’s eastern flank, while a Dan presidency would reinforce pro-Western alignment.

Russia–Ukraine Talks: A Flicker of Movement

On 16 May, Istanbul hosted renewed talks between Ukraine and Russia. The only tangible outcome: a 1,000-for-1,000 prisoner exchange. A Ukrainian ceasefire proposal was swiftly rejected by Moscow, which insists on territorial concessions Kyiv won’t entertain. The Kremlin appears to be playing for time while consolidating military positions. Still, the fact that direct talks resumed is notable in itself.

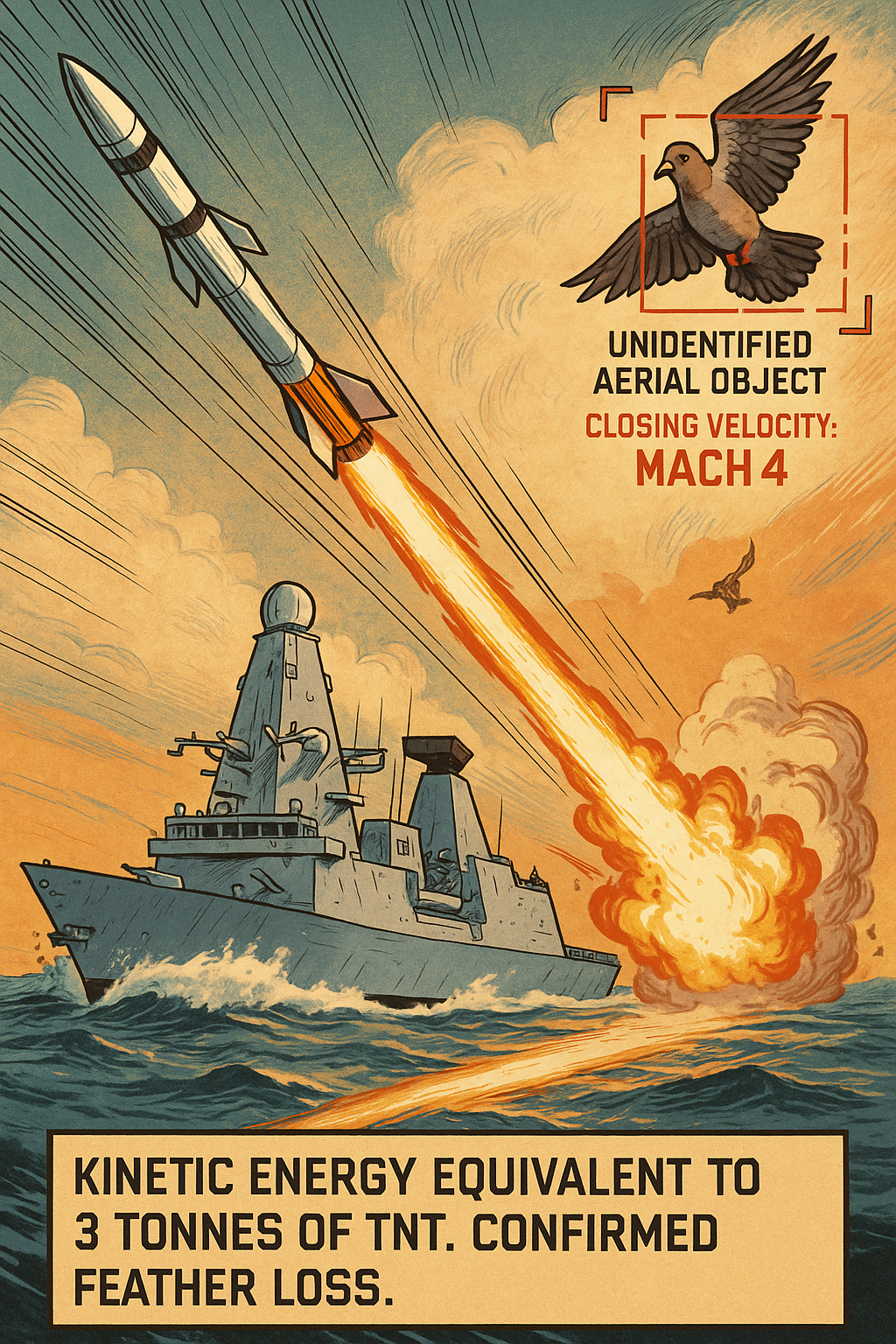

HMS Dragon and the Supersonic Kill

In a UK first, HMS Dragon intercepted and destroyed a supersonic missile during NATO’s Formidable Shield 25 exercise off the Scottish coast. The use of the Sea Viper missile system marked a major milestone in Britain’s point-defence capabilities, especially against Mach 4+ threats increasingly present in both European and Pacific theatres.

UK–EU Defence Pact: Realignment, Not Reversal

The UK and EU edged toward signing a new defence and security pact—the most substantial post-Brexit rapprochement to date. It would allow British troops to take part in EU-led missions and improve inter-military logistics. However, British defence firms will still need bilateral negotiations to access the EU’s €150 billion rearmament fund, potentially complicating procurement integration.

NATO’s Budget Warning: 2% is No Longer Enough

At a defence ministers’ gathering on 16 May, Germany and Italy backed calls to push NATO’s defence spending target beyond the 2% GDP mark, arguing it’s now a floor, not a ceiling. With Eastern Europe rearming and France repositioning post-Africa, the alliance is in fiscal catch-up mode—trying to match ambition with actual capability.

India–Pakistan: From Fire to Framework

Having exchanged missile and drone strikes from 7–10 May, India and Pakistan entered de-escalation talks this week. New Delhi’s BrahMos missile was credited with deterring further aggression. Meanwhile, Lt. Gen. Anindya Sengupta’s visit to IIT-Kanpur signalled India’s deeper military-academic integration in robotics, UAVs, and cybersecurity—hinting at the long game.

3. How These Events Connect (or Don’t)

This week underscores three converging realities:

- A Return to Transactional Statecraft: The U.S.–Gulf and U.S.–China developments reveal a shared strategic posture—less ideology, more deals. States are rebalancing, hedging, and monetising relationships instead of simply reaffirming alliances.

- Regional Friction, Global Implications: Romania’s vote, India–Pakistan’s skirmish, and Ukraine–Russia talks all demonstrate how localised political shifts can either bolster or strain wider strategic blocs like NATO and the Quad.

- Posture vs. Capability: Europe’s vows on spending, Britain’s missile interception, and India’s R&D advances reflect increasing investment in posture. But actual readiness—be it defence-industrial agility or alliance coordination—still lags the rhetoric.

4. Predictions for the Month Ahead

- Middle East: Expect Gulf states to follow up with domestic framing of Trump’s tour to extract maximum diplomatic leverage. Watch Syria for signs of emerging U.S. rapprochement.

- China–U.S.: The 90-day tariff truce will hold—for now. But tech export controls and chip disputes will re-escalate if no structural agreements follow.

- Romania: A Simion victory could accelerate Eurosceptic shifts in other Eastern European capitals, especially Slovakia and Hungary.

- Libya & Mali: France may be drawn back into West African affairs, albeit with more covert or proxy tools than before.

- UK–EU Defence Pact: Expect resistance in Westminster over sovereignty optics—though MOD and FCDO will likely push for quiet ratification.

5. Fun Fact of the Week

How fast is too fast?

During Exercise Formidable Shield, the Sea Viper missile launched by HMS Dragon reached Mach 4 in under 2.5 seconds, marking the first successful British intercept of a supersonic target. The missile’s kinetic energy at impact was equivalent to three tonnes of TNT—enough to obliterate any inbound anti-ship threat… or, indeed, an errant pigeon at altitude.

End of Report