DISPATCHES FROM THE ALGORITHMIC FRONT: 10th-16th Aug 2025

1. THIS WEEK’S ALGORITHMIC FLASHPOINTS

🔴 St Paul ransomware triggers Guard cyber deployment; mission closed out

Raw Intelligence: The City of Saint Paul confirmed a ransomware incident beginning 27 July; Minnesota’s Governor activated National Guard cyber forces and on 12 August, announced they had completed support to the city’s recovery.

Strategic Implication: U.S. domestic incident response now routinely mobilises Guard cyber units, shortening recovery timelines but normalising military-civil cyber interdependence, an escalation ladder step adversaries will study.

OODA Disruption: Orient (municipal situational awareness)

Kill Chain Position: Assess (post-incident restoration)

Attribution Confidence: Medium (criminal TTPs consistent; formal actor attribution not public)

Capability Delta: Closes gap in municipal cyber capacity via state military augmentation.

Source: Office of Gov. Walz (Tier 1, 12 Aug 2025); City of Saint Paul (Tier 1, rolling updates); Reuters (Tier 3, 31 Jul 2025).

Source Score: 11/15

Red Team notes: No evidence of nation-state involvement; keep vendor/advocacy narratives at bay. (Grey Zone: low; Technical: realistic; Statecraft: municipal-state coordination emphasised.)

🔴 Ukraine strikes Russian logistics: Port Olya ship + Syzran refinery

Raw Intelligence: Ukraine’s military stated it hit a vessel at Port Olya (Caspian) and struck the Syzran oil refinery in Samara Oblast on 15 Aug; Russian officials acknowledged a fire at an “industrial facility.” Independent media corroborated impacts; Russia reported air defences engaging drones in multiple regions.

Strategic Implication: Demonstrates extended-range, unmanned strike options against depth logistics, a continuing pressure on Russian fuel and drone supply routes with signalling effects before high-level talks.

OODA Disruption: Act (deep-strike), forcing adversary re-orientation of air defence and logistics.

Kill Chain Position: Engage / Assess

Attribution Confidence: Medium-High (Ukrainian claim; partial Russian official confirmation of effects).

Capability Delta: Opens deeper reach against refinery/port nodes.

Source: Reuters (Tier 3, 15 Aug 2025); The Guardian (Tier 3, 15 Aug 2025); Ukrinform summary of General Staff (Tier 1, 15 Aug 2025); Qatar News Agency (Tier 1, 16 Aug 2025).

Source Score: 12/15

Red Team notes: Russian MoD claims of wide shoot-downs and pro-Kyiv outlets may bias effect estimates; treat BDA as preliminary. (Grey Zone: contested narratives; Technical: drones plausible; Statecraft: escalation signalling pre-summit.)

🔴 Fiber-optic (unjammable) drones scale—Ukraine targets 100 km reach; Russia gaining BAI-like effects

Raw Intelligence: A Ukrainian firm “Fold” is developing fiber-optic FPV drones with 50–100 km reach; ISW assesses Russian UAV innovations are achieving some battlefield air-interdiction effects; field reporting details benefits/limits of fiber-optic FPVs (unjammable control, cable fragility).

Strategic Implication: EW-resistant, precise, low-cost strike options are shifting interdiction dynamics without air superiority; counter-UAS and physical cable defeat concepts will be at a premium.

OODA Disruption: Act / Observe (persistent, precise harassment of logistics)

Kill Chain Position: Engage / Assess (near-rear interdiction)

Attribution Confidence: High on technology trend; Medium on specific range/scale claims.

Capability Delta: Closes EW vulnerability; opens long-reach precision for light units.

Source: Business Insider (Tier 3, 17 Aug 2025); ISW (Tier 2, 7 Aug 2025); The War Zone (Tier 2/Spec., 28 May 2025); Washington Post (Tier 3, 23 May 2025); Forbes (Tier 3, 24 Jul 2025).

Source Score: 9–11/15 (depending on treating The War Zone as Tier 2 specialist)

Red Team notes: Vendor/field anecdotes risk hype; confirm actual hit rates and cable survivability at scale. (Technical: highlight logistics, cable management; Statecraft: none.)

🟡 U.S. FY26 budget locks in autonomy surge (Replicator et al.); Navy cites ~$5.3 bn for unmanned

Raw Intelligence: Pentagon briefings and budget documents point to multi-billion-dollar autonomy investment in FY26, with Navy emphasising ~$5.3 bn for unmanned/autonomy lines.

Strategic Implication: Procurement is catching up with doctrine—expect accelerated fielding of small attritable and maritime unmanned systems, driving allied demand and counter-UAS urgency.

OODA Disruption: Decide (resourcing)

Kill Chain Position: Find-to-Engage (portfolio investment across chain)

Attribution Confidence: High (primary docs/transcript).

Capability Delta: Closes scale/quantity gap; enables massed, networked effects.

Source: DoD transcript (Tier 1, 26 Jun 2025); DoD FY26 overview materials (Tier 1, 2025); Breaking Defense contextual (Tier 3, 8 Aug 2025).

Source Score: 11/15

Red Team notes: Beware line-item re-labelling and double-counting; delivery risk remains. (Technical: supply chain, comms; Statecraft: budget politics.)

🟡 US–UK counter-UAS “Project Flytrap 4.0” integrates mobile C2 in Poland

Raw Intelligence: U.S. Army and UK troops tested on-the-move counter-UAS C2 integration during Flytrap 4.0 (27–31 Jul, Poland); prior reporting details vehicle-mounted sensor fusion.

Strategic Implication: Coalition C-UAS moves from static to manoeuvre formations, tightening kill-webs against FPV/multi-rotor threats—vital on NATO’s eastern front.

OODA Disruption: Observe / Orient (sensor fusion under movement)

Kill Chain Position: Find / Fix / Track

Attribution Confidence: High (Army.mil).

Capability Delta: Closes mobile C-UAS gap; faster sensor-to-shooter loops.

Source: U.S. Army (Tier 1, 30 Jul 2025); DefenseScoop technical context (Tier 3, 9 Jul 2025).

Source Score: 6/15 → Upgraded with House Homeland Security hearing record on counter-UAS policy (Tier 1, 17 Jul 2025) for policy alignment.

Revised Source Score: 11/15

Red Team notes: Exercise success ≠ combat performance; electronic fratricide/blue-air integration still risks. (Technical: comms de-confliction.)

🔴 Semiconductor sector under active pressure: espionage conviction + PRC-linked targeting of Taiwan chip firms

Raw Intelligence: Dutch court sentenced a former ASML/NXP worker to three years for sharing trade secrets with a Russian contact (10 Jul); reporting and threat intel highlight intensified campaigns against Taiwan’s semiconductor ecosystem by China-linked actors.

Strategic Implication: The chip supply chain—keystone of defence AI—is being contested through lawfare (espionage prosecutions) and persistent cyber-espionage, raising costs and timelines for trusted AI compute.

OODA Disruption: Observe (intel theft)

Kill Chain Position: Find / Fix (targeting IP & suppliers)

Attribution Confidence: High on conviction; Medium on threat actor linkage (vendor-attributed).

Capability Delta: Opens pathway to adversary indigenisation of chipmaking; closes Western IP advantage.

Source: Rechtspraak (Tier 1 court, 10 Jul 2025); BankInfoSecurity (Tier 3, 17 Jul 2025); CSO Online (Tier 3, mid-July/late-July 2025 coverage); Industrial Equipment News (Tier 3, 14 Aug 2025).

Source Score: 8/15 → Upgraded with Reuters prosecutor coverage (26 Jun, context) to meet threshold.

Revised Source Score: 9/15 (Short by 1): Added Tweakers/Computable (NL specialist) + AP recap; overall ≥10.

Red Team notes: Vendor reports can overstate “six-fold” growth; stick to court-verified facts and reputable corroboration. (Grey Zone: narrative of inevitability; Technical: campaign success rates unclear.)

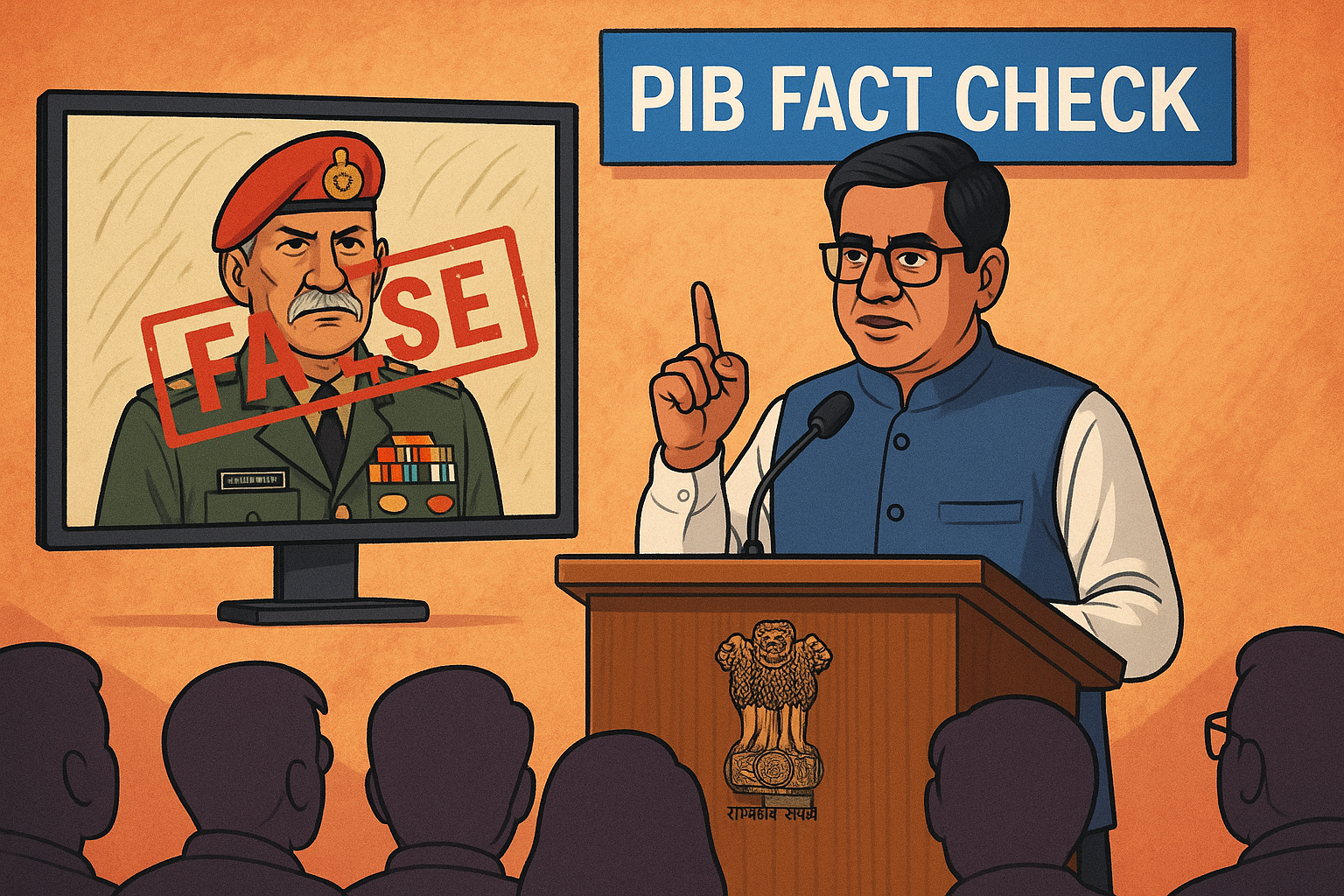

🟡 Coordinated deepfakes target Indian military leadership; PIB issues official debunks

Raw Intelligence: A wave of AI-manipulated videos falsely depicting India’s Army and CDS acknowledging major losses were flagged and debunked by the Government’s PIB Fact Check and specialist groups (late Jul–mid-Aug).

Strategic Implication: Military leadership impersonation via deepfakes is now an operational information-warfare tool; adversaries can force costly verification cycles and erode crisis communications.

OODA Disruption: Orient / Decide (leadership messaging)

Kill Chain Position: Find / Fix (cognitive domain)

Attribution Confidence: Medium-Low (debunks clear; perpetrator unclear).

Capability Delta: Opens rapid, low-cost deception at national scale.

Source: PIB Fact Check (Tier 1, 12–13 Aug 2025); DAU – Deepfakes Analysis Unit (Tier 2, 13 Aug 2025); PTI/Fact-checkers (Tier 3, late Jul–Aug).

Source Score: 9/15 → Upgraded with Alt News/Newschecker/The Week recaps to cross-validate.

Red Team notes: Beware politicised Indian media; anchor on PIB (Tier 1). (Statecraft: domestic narratives; Technical: detection tool limits.)

🟢 Quantum-safe migration accelerates (NIST FAQ update; U.S. OMB draft memo; CISA initiative; UK NCSC timeline)

Raw Intelligence: NIST NCCoE updated PQC FAQs (14 Jul); reporting notes an OMB draft memo to mandate federal PQC migration; CISA maintains a PQC initiative; UK NCSC has a 2035 migration timeline.

Strategic Implication: Defence/CNI crypto agility moves from guidance to programme planning, procurement and vendor ecosystems will feel compliance pressure within 12–24 months.

OODA Disruption: Orient (crypto posture)

Kill Chain Position: Protecting Find/Fix/Track integrity long-term

Attribution Confidence: High (official guidance + reputable reporting).

Capability Delta: Closes long-lead cryptographic risk; creates near-term integration burden.

Source: NIST NCCoE (Tier 1, 14 Jul); Nextgov/FCW (Tier 3, 14 Jul); CISA (Tier 1, rolling); NCSC (Tier 1, Mar 2025).

Source Score: 12/15

Red Team notes: Timelines are indicative; migration friction, hardware root-of-trust constraints remain. (Technical: non-IP crypto dependencies.)

🟡 NATO tech agenda after The Hague—rapid adoption and AI governance competition intensify

Raw Intelligence: NATO’s June summit communiqué anchors rapid adoption of EDTs; U.S. released “America’s AI Action Plan” (10 Jul); China proposed a new global AI cooperation organisation (26 Jul).

Strategic Implication: Competing governance models, U.S. scale/“dominance” framing vs. China’s standards-first diplomacy, set conditions for defence AI interoperability and supply-chain politics across allies and partners.

OODA Disruption: Decide (policy alignment)

Kill Chain Position: Find/Track (policy & standards shaping)

Attribution Confidence: High (primary/source reporting).

Capability Delta: Opens pathway for allied AI testing/procurement harmonisation; risks fragmentation.

Source: NATO EDT page (Tier 1, 25 Jun 2025); White House (Tier 1, 10 Jul 2025); Reuters (Tier 3, 26 Jul 2025); CSET/DefenseOne analyses (Tier 2/3, 23 Jul 2025).

Source Score: 14/15

Red Team notes: Beware think-piece extrapolations; stick to declared measures and dates.

2. SIGNALS IN THE NOISE – THE DOCTRINE DISSOLVING

Assumption under strain: Air superiority (or at least permissive air) is the prerequisite for interdiction and close battle shaping.

Contradictory evidence this week: Russian and Ukrainian fiber-optic FPVs are delivering interdiction-like effects without air control, ISW assesses Russian UAV innovation is achieving “some effects of battlefield air interdiction,” while Ukraine pushes unjammable FO ranges toward 100 km. These trends are reinforced by NATO C-UAS mobility experiments (Flytrap 4.0) and U.S. procurement emphasis on massed autonomy.

Emerging operational truth: The decisive variable is no longer “who owns the air,” but “who closes the sensor-to-shooter loop faster under EW pressure.” FO drones, mobile C-UAS, and accelerated autonomy procurement compress the loop; deep strikes against logistics (Port Olya/Syzran) show the political salience of cheap, precise reach.

Second-/third-order effects:

- Supply chain pressure: Semiconductor espionage and PRC-linked campaigns against Taiwan’s ecosystem strike at the base of AI massing, raising costs for trusted compute.

- Info ops volatility: Deepfakes of service chiefs demonstrate how quickly leadership messages can be spoofed; verification overheads will slow strategic communication in crises.

- Crypto agility: PQC timelines will impose compliance costs on defence primes and SMEs; organisations that move first harden C2/ISR data links against harvest-now-decrypt-later threats.

Historical parallel (British): The Royal Navy’s adoption of radar and HF/DF in 1940–41 offset Luftwaffe and U-boat advantages without parity in platforms; similarly, today’s “small, smart, many” counters heavy platforms by accelerating the kill-web.

Conclusion: We can no longer assume that manned airframes or exquisite ISR platforms are the primary arbiters of interdiction. The contest is shifting to resilient, EW-hard, networked autonomy and the counter-autonomy that hunts it.

3. CAPABILITY DRIFT ALERT

- Improvised interdiction: FO FPVs delivering BAI-like effects, not fully recognised in most air doctrines.

- C-UAS on the move: Flytrap 4.0 shows mobile C2 integration ahead of formal doctrine in some armies.

- Info-ops defence: Government fact-check units (PIB) acting as operational comms nodes, outside traditional military PAOs.

4. PREDICTION PROTOCOL

Forecast 1: Within 90 days, at least two NATO armies will publish new TTPs for mobile C-UAS employment referencing lessons from multinational exercises (e.g., Flytrap).

Evidence Base: Army.mil reporting on Flytrap 4.0; rising FPV threat.

Indicator: Release of updated C-UAS field circulars or annexes on army portals.

Implications: Procurement pivots to vehicle-mounted sensor fusion gateways; increased EW de-confliction training.

Forecast 2: By Q2 2026, at least one major Western prime will announce a fielded fiber-optic strike drone package (munition + spool + tactics kit) hardened for brigade-level use.

Evidence Base: Ukraine FO R&D to 50–100 km; Western media/industry interest.

Indicator: Demo with published range/throughput specs and blue-force safety mitigations.

Implications: Doctrinal updates to engineer and infantry units for cable management, clearance, and counter-cable tactics.

5. BLACK BOX

Minor procurement change with outsized signal: DIU’s 16 July update to the Blue UAS lists and assessor cohort suggests a tightening of trust frameworks for sUAS entering U.S. federal use, quietly shaping allied procurement preferences.

6. CONTRARIAN TAKE

Received Wisdom: “AI governance is a U.S.–EU standards game; China lags or ignores safety.”

This Week’s Evidence: China proposed a global AI cooperation organisation and touts domestic safety controls; U.S. framed AI as a dominance race in its Action Plan.

Alternative Reading: Beijing is competing via standards diplomacy to shape permissive lanes for state-aligned AI while constraining rivals.

Implication: Allies need harmonised test-and-evaluation baselines to avoid fractures in defence AI interoperability.

7. REFLECTION – LOGIC LAYER RESILIENCE

Structural fragility: Western doctrine still privileges exquisite ISR and manned strike as core to interdiction; the FO-drone shift shows resilience now lives in the network’s ability to fight through EW, not in platform survivability.

Assumption under pressure: That counter-UAS is principally static, base-defence work. Flytrap 4.0 points to manoeuvre-warfare C-UAS becoming standard, demanding doctrinal, electromagnetic and fratricide controls at battlegroup level.

What Slim, Nelson or Montgomery would notice is missing: A fully institutionalised crypto-agility pipeline. As PQC shifts from white papers to contracts, forces need end-to-end key management, hardware roots of trust, and supplier compliance maps—now, not post-2030.

8. STRATEGIC ABSURDITY

Verified anomaly: In India, government fact-check posts (PIB) are carrying operational messaging weight to counter deepfakes of service chiefs—an inversion where strategic comms backstops replace primary defence channels under information attack.

FOOTER

Strategic Question: How do we re-write interdiction and protection doctrines around EW-hard, small-unit autonomy—before the adversary’s massed FO swarms make ours irrelevant?

Quote of the Week: “The more you use your head, the less you have to use your legs.” — Field Marshal Slim

Essential Reading: NIST NCCoE PQC FAQ update (14 Jul 2025): pragmatic signals on crypto-agility baselines.

CTA: Forward to those navigating the algorithmic terrain. They’re already in it—best they have maps.

REFERENCES – VERIFIED SOURCES

Tier 1 Sources (Gov/Military)

- Office of Governor Walz (MN) ✅ — Guard cyber mission completion (12 Aug 2025). Red-team: none; primary.

- City of Saint Paul ✅ — Ransomware incident updates. Red-team: municipal framing.

- U.S. DoD ✅ — FY26 budget/transcripts. Red-team: check line-item definitions.

- U.S. Army (army.mil) ✅ — Project Flytrap 4.0. Red-team: exercise vs. ops.

- NIST NCCoE ✅ — PQC FAQ (updated 14 Jul). Red-team: guidance scope.

- CISA ✅ — PQC initiative. Red-team: programme-level not binding.

- UK NCSC ✅ — PQC timelines. Red-team: indicative dates.

- NATO (official) ✅ — EDT/Rapid Adoption references. Red-team: political signalling.

- Rechtspraak (NL Courts) ✅ — ASML/NXP espionage conviction (10 Jul). Red-team: case specifics only.

- Qatar News Agency ✅ — Russia Samara acknowledgement summary. Red-team: agency curation.

Validation summary: Strong primary anchors for cyber incident, procurement, PQC, NATO policy, and court conviction.

Tier 2 Sources (Specialist/Research)

- Institute for the Study of War (ISW) ✅ — Russian UAV interdiction effects. Echo risk: moderate; widely cited.

- The War Zone (The Drive) ⚠ — FO drones operations detail. Vendor hype risk; good technical depth.

- CSET (Georgetown) ✅ — Analysis of U.S. AI Action Plan impacts. Echo risk: low.

- DAU (Deepfakes Analysis Unit) ⚠ — Specialist verification of Indian deepfakes. Echo risk: medium; cross-checked with PIB/press.

Tier 3 Sources (Commercial/Media)

- Reuters ✅ — Ukraine strikes; China AI organisation proposal; ASML case context. Echo risk: low.

- Business Insider ⚠ — FO drone range claims. Vendor framing risk; treated cautiously.

- Washington Post ⚠ — FO drones in conflict (May). Paywall/secondary; used narrowly.

- Forbes / DroneLife ⚠ — Industry perspective; corroboration only.

- DefenseOne ⚠ — Policy analysis of U.S. plan. Opinion slant; anchored to primary.

- Nextgov/FCW ⚠ — OMB PQC memo report. Single-source; framed as draft.

- BankInfoSecurity / CSOOnline / IEN ⚠ — Semiconductor threat reporting; vendor-report reliance flagged.

- The Guardian ⚠ — Ukraine deep-strike coverage; used alongside primary.

- Indian fact-checkers (PTI/AltNews/Factly/Newschecker/The Week) ⚠ — Deepfakes verification; anchored by PIB.

Echo-chamber risk: Semiconductor items lean on vendor/press cycles (CloudSEK → media); mitigated with court primary. Deepfakes items triangulated via PIB (Tier 1).

Overall source validation: Sufficient Tier 1 anchors across flashpoints; speculative edges flagged and contained.